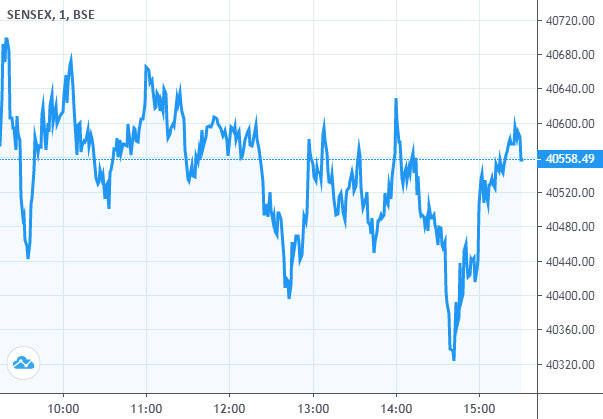

On October 22, BSE Sensex was down 148.82 points to close at 40,558.49 while the NSE Nifty50 shed 41.20 points at 11,896.50. Stock market broke the four-day gaining momentum as Nifty failing to hold the 11,900. Most action was seen in power, oil & gas and metal space while profit-taking was seen in pharma, IT and bank stocks.

According to pivot charts, Pivot point for market is 11,886.48. The key support levels for the Nifty is placed at 11,833.42, followed by 11,770.38. If the index moves up, the key resistance levels to watch out for are 11,949.52 and 12,002.58.

Day High - 11,939.55 Day Low - 11,823.45 Market Close - 11,896.45

Pivot Point = (11,896.45+11,939.55+11,823.45) = 11,886.48

Support 1 = 2*11,886.48-11,939.55 = 11,833.42

Support 2 = 11,886.48- (11,939.55-11,823.45) = 11,770.38

Resistance 1 = 2*11,886.48-11,823.45 = 11,949.52

Resistance 2 = 11,886.48+ (11,939.55-11,823.45) = 12,002.58

Stocks in News :

- National Peroxide net profit surged 286 percent to Rs 22.33 crore in the quarter ended September 2020 as against Rs 5.78 crore during the previous quarter ended September 2019.

- Bajaj auto has reported an 18.8 percent year-on-year decline in September quarter standalone profit to Rs 1,138.2 crore.

- Asian paint net profit grew by 1.2 percent year-on-year to Rs 851.9 crore and revenue increased 5.9 percent YoY to Rs 5,350.2 crore in July-September period 2020.

- Sterlite technologies 63 percent year-on-year decline in consolidated net profit for the second quarter ended September 2020 at Rs 58.5 crore, hurt by lower revenue.

- Indian Bank on October 22 reported a 15% rise in net profit at Rs 412.28 cr for the second quarter ended September, despite increase in provisions for bad loans.

- Affle platforms recognised as top performers in AppsFlyer Performance Index.

- Munjal Auto Industries has received reaffirmation in credit ratings for bank facilities and commercial paper from ICRA as mentioned : LT Bank facilities - ICRA AA-; Stable, ST Bank facilities - ICRA A1+, Commercial paper - ICRA A1+

- Syngene International has registered a 34.3% decline in consolidated net profit to Rs 84 cr during the quarter ending September 2020 (Q2FY21), compared to a profit of Rs 128 cr in the corresponding period of the previous year.

No comments:

Post a Comment