You can apply on click on Link

Gland Pharma Ltd, established in Hyderabad, India in 1978 and have expanded from liquid parenterals to cover other elements of the injectables value chain, including contract development, own development, dossier preparation and filing, technology transfer. It manufactures a diversified range of high-quality complex injectables. The company offers products like sterile injectables, oncology, and ophthalmics, complex injectables (peptides, suspensions, hormonal products, long-acting injectables), NCE-1s, First-to-File products etc.

As of June 30, 2020, Gland Pharma along with our partners had 267 ANDA filings in the United States, of which 215 were approved and52 were pending approval. The 267 ANDA filings comprise 191 ANDA filings for sterile injectables, 50 for oncology and 26 for ophthalmics related products. Out of these 267 ANDA filings, 101 represent ANDAs owned by Gland Pharma, of which 71 ANDA filings are approved and 30 are pending approval. As of the same date, we along with Gland Pharma partners had a total of 1,427 product registrations, comprising 371 product registrations in the United States, Europe, Canada and Australia, 54 in India and 1,002 in the Rest of the world. Gland Pharma have a consistent regulatory compliance track record and all facilities are approved by the USFDA from whom Gland Pharma have had no warning letters since the inception of each facility.

The company follows a B2B model to sell its products in more than 60 countries including the US, Canada, Australia, India, Europe, etc. Leading pharma companies i.e. Sagent Pharmaceuticals, Apotex Inc. Athnex Pharmaceutical Division, LLC, Fresenius Kabi USA, LLC, etc. are some of the key customers.

It has 7 robust manufacturing units in India comprising 4 finished formulations facilities, 22 production lines, and 3 APIs.

Competitive Strength :

- The extensive product portfolio of complex injectables.

- Diversified B2B model with a targeted B2C model in India.

- Strong manufacturing capabilities.

- Robust financial track record.

- Experienced and qualified managerial team.

Company Promoters :

Fosun Pharma Industrial Pte. Ltd and Shanghai Fosun Pharmaceutical (Group) Co. Ltd is the company promoters.

Company Financials :

| Particulars | For the year/period ended ( in million) |

|---|

| 30-June-20 | 31-Mar-20 | 31-Mar-19 | 31-Mar-18 |

| Total Assets | 46,912.65 | 40,860.39 | 35,235.49 | 29,294.68 |

| Total Revenue | 9,162.89 | 27,724.08 | 21,297.67 | 16,716.82 |

| Profit After Tax | 3,135.90 | 7,728.58 | 4,518.56 | 3,210.51 |

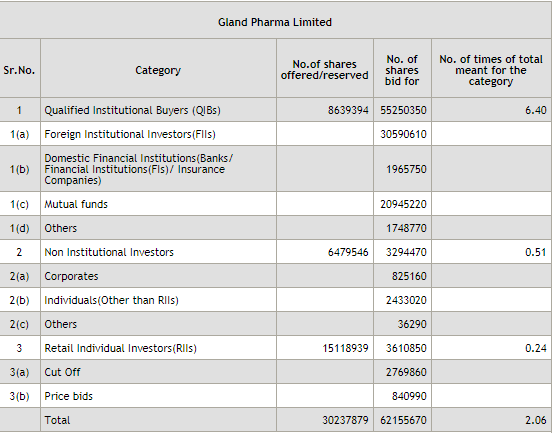

IPO Detail :

Issue Size - 43,196,968 Eq Shares of Rs 1 (aggregating up to Rs 6,479.55 Cr)

Fresh Issue - 8,333,333 Eq Shares of Rs 1 (aggregating up to Rs 1,250.00 Cr)

Offer for Sale - 34,863,635 Eq Shares of Rs 1 (aggregating up to Rs 5,229.55 Cr)

IPO Price - Rs 1490 to Rs 1500 per equity share

Market Lot - 10 Shares ( Min Order quantity )

Maximum Order Quantity for Retail - 130 Shares ( 13 Lots )

Finalisation of Basis of Allotment - Nov 17, 2020

Initiation of Refunds - Nov 18, 2020

Credit of Shares to Demat Account - Nov 19, 2020

IPO Shares Listing Date - Nov 20, 2020