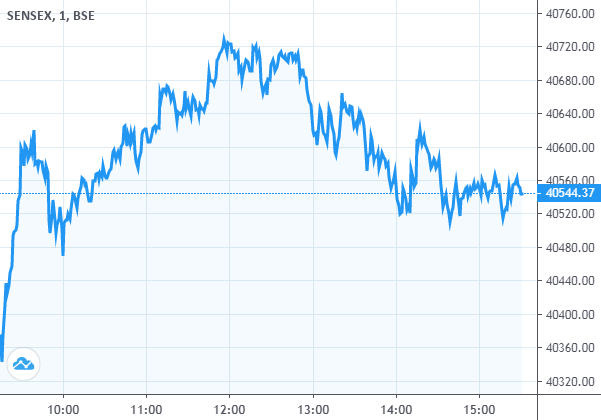

On October 20, BSE Sensex was up 112.77 points to close at 40,544.37 while the NSE Nifty50 gained 23.75 points at 11,896.80 and formed bullish candle on the daily charts. Nifty failed to hold on to 11,900 towards the close of the trade. Most action was seen in realty, telecom, IT, consumer discretionary, and consumer durable stocks while oil & gas, public sector, energy and power stocks saw profit-taking.

According to pivot charts, Pivot point for market is 11,883.43. The key support levels for the Nifty is placed at 11,817.61, followed by 11,771.43. If the index moves up, the key resistance levels to watch out for are 11,929.61 and 11,995.43.

Day High - 11,949.25 Day Low - 11,837.25 Market Close - 11,896.80

Pivot Point = (11,896.80+11,949.25+11,837.25) = 11,883.43

Support 1 = 2*11,883.43-11,949.25 = 11,817.61

Support 2 = 11,883.43- (11,949.25-11,837.25) = 11,771.43

Resistance 1 = 2*11,883.43-11,837.25 = 11,929.61

Resistance 2 = 11,883.43+ (11,949.25-11,837.25) = 11,995.43

Stocks in News :

- Aavas Financiers board has approved plans to raise up to Rs 100 cr by issuing bonds on private placement basis.

- State-owned hydro power giant NHPC board approved a proposal to start merger of Lanco Teesta Hydro Power Ltd into the company.

- Indian Oil Corporation has issued 20000, 5.50% Unsecured, Listed, Rated, Taxable, Redeemable, Nonconvertible Debentures (Series - XIX) of Rs.10,00,000 each aggregating to Rs 2000 crore on Private Placement basis on 20 October 2020.

- Drug firm Granules India reported a 70.82% rise in its consolidated net profit to Rs 163.63 cr for the second quarter ended September 30, mainly on account of robust sales.

- Cipla Limited has launched generic Nintedanib for the treatment of Idiopathic Pulmonary Fibrosis (IPF).

- Moody's Investors Service has placed Vedanta Resources Limited's B1 corporate family rating (CFR) under review for downgrade.

- Board of Directors of KIOCL Limited has unanimously approved a proposal for the buyback of 1.42 cr equity shares of the face value of Rs 10/- each.

No comments:

Post a Comment