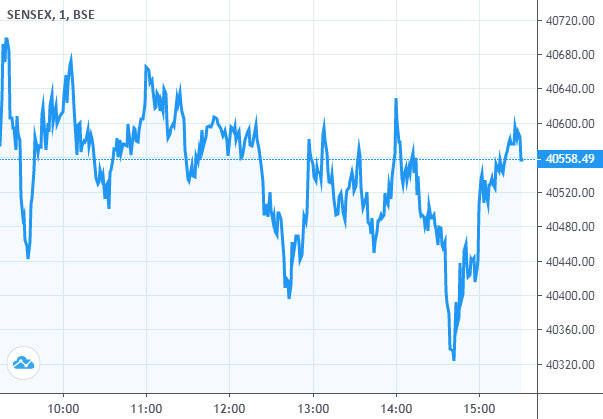

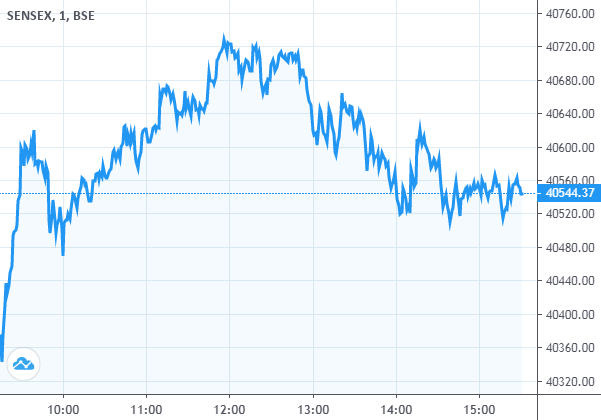

On October 29, BSE Sensex was down 172.61 points to close at 39,749.85 while the NSE Nifty50 lost 58.80 points at 11,670.80 and formed a bullish candle on daily chart. Except IT and energy, all other sectoral indices ended lower led by FMCG, pharma, metal and auto. BSE Smallcap index down 0.5 percent.The top losers on the Nifty were L&T, Titan, Adani Ports, ONGC, Axis Bank and Adani Ports, while gainers were Asian Paint, Tech Mahindra, Ultra cement, Kotak bank, Wipro.

According to pivot charts, Pivot point for market is 11,673.80. The key support levels for the Nifty is placed at 11,603.45, followed by 11,536.10. If the index moves up, the key resistance levels to watch out for are 11,741.15 and 11,811.50.

Day High - 11,744.15 Day Low - 11,606.45 Market Close - 11,670.80

Pivot Point = (11,670.80+11,744.15+11,606.45) = 11,673.80

Support 1 = 2*11,673.80-11,744.15 = 11,603.45

Support 2 = 11,673.80- (11,744.15-11,606.45) = 11,536.10

Resistance 1 = 2*11,673.80-11,606.45 = 11,741.15

Resistance 2 = 11,673.80+ (11,744.15-11,606.45) = 11,811.50

Stocks in News :

- APL Apollo Tubes Q2 profit rises 72% to Rs 103 crore.

- Gateway Distriparks profit falls 75% to Rs 4.26 crore in Q2.

- Blue Star posts net profit of Rs 15.32 crore for Q2.

- CG Power and Industrial Solutions posts Rs 109 crore net profit in Q2.

- Mahindra Holidays & Resorts India Q2 profit up 18% to Rs 28.7 crore.

- Route Mobile Q2 profit more than doubles to Rs 32.7 crore.

- Vodafone Idea Q2 loss narrows to Rs 7,218 crore

- IndiGo reported a loss of Rs 1,194 crore in Q2.

- HPCL board to consider share buyback on November 4.

- Laurus Labs reports highest-ever quarterly profit at Rs 242 crore in Q2.