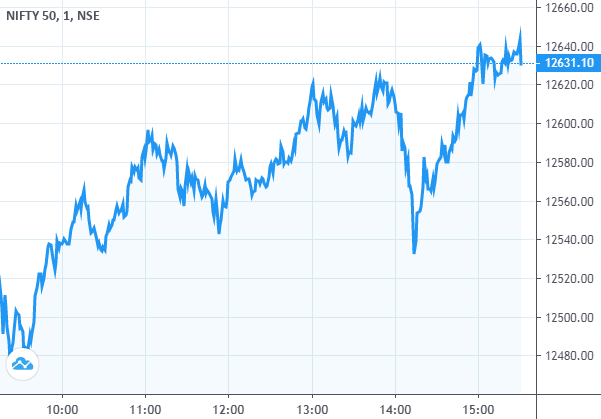

On November 10, BSE Sensex was up 680.22 points to close at 43,277.65, while the Nifty 50 gained 170.05 points to 12,631.10 and formed a bullish candle on daily chart. Most action was seen in banks, finance, capital goods, realty, as well as oil & gas while mild profit booking was seen in IT, healthcare, and telecom stocks. The top gainers on the Nifty included Bajaj Finance, Indusind Bank, LT, Bajaj Finserv, SBI and top losers are Tech Mahindra, Cipla, HCL Technology, Divis lab and Nestle Industry.

According to pivot charts, Pivot point for market is 12,583.42. The key support levels for the Nifty is placed at 12,522.93, followed by 12,414.77. If the index moves up, the key resistance levels to watch out for are 12,691.58 and 12,752.07.

Day High - 12,643.90 Day Low - 12,475.25 Market Close - 12,631.10

Pivot Point = (12,631.10+12,643.90+12,475.25) = 12,583.42

Support 1 = 2*12,583.42-12,643.90 = 12,522.93

Support 2 = 12,583.42- (12,643.90-12,475.25) = 12,414.77

Resistance 1 = 2*12,583.42-12,475.25 = 12,691.58

Resistance 2 = 12,583.42+ (12,643.90-12,475.25) = 12,752.07

- Exide Industries Q2 net up 4% at Rs 257 crore.

- Motherson Sumi Q2 net profit up 3% to Rs 388 crore.

- Tata Power Q2 net up 10% to Rs 371 crore.

- RITES Q2 consolidated profit down 44% at Rs 132 crore.

- IDFC net loss narrows to Rs 147 crore in Q2.

- Dalmia Bharat Sugar reports 11% rise in Q2 profit.

- GAIL profit dips 9% to Rs 1,068.16 crore in Q2 on gas marketing woes.

- TTK Prestige Q2 profit falls 19% to Rs 65 crore.

- Godfrey Phillips India Q2 net profit falls 9.23% to Rs 103.06 crore.

- M&M Standalone September 2020 Net Sales at Rs 11,710.46 crore, up 5.73%.

- Tribhovandas Consolidated September 2020 Net Sales at Rs 273.17 crore, down 30.53%.

- Exide Ind Consolidated September 2020 Net Sales at Rs 4,011.39 crore, up 6.16%.

- Dalmia Sugar Consolidated September 2020 Net Sales at Rs 719.53 crore, up 78.41%.

No comments:

Post a Comment